Covesting Launches Better Risk Management With Revised Margin Allocation Chart

Updated: Sep 13, 2021 at 16:18

The peer-to-peer Covesting copy trading module has received a crucial risk management update, designed to provide users – notably followers – with more intel to use related to a strategy manager’s margin allocation.

How much margin a strategy manager applies to their positions can either indicate a risk-taker, or a more conservative trader, one of which is a more desirable situation in the long run for capital safety.

Here is more on this remarkable update and revision to the margin allocation chart on

Covesting, and how to read the info that is provided and use it to your advantage.

Why risk management matters more than profits

Ask any top trader who has a long, storied track record of success and making millions and they’ll all tell you the same thing: it isn’t how much money you make, but how much you keep. Proper risk management is paramount to growing capital, even more so than profitable trades themselves. The reason being is that anyone can get lucky and make a killing with trading – that is the appeal of trading in the first place.

But being calculated with risk management can protect capital even when those bets are wrong and the trader isn’t so lucky. With a proper capital protection system in place such as the 1% rule, a new trader should be able to make 100 losing trades before they wipe out their capital. Without it or tools like the stop loss order, just one trade could have such an impact.

Some of the biggest mistakes traders can make is when things go wrong and they instead double-down on losing positions, or take too big of risks in the first place. By being so overly exposed, stress can build and lead to more mistakes being made such as putting far too much margin on the line. If margin allocation falls below what is available in a trader’s account, positions will be liquidated and losses can be substantial.

Covesting transparency turned up a notch with latest update

One of the prime benefits to the Covesting copy trading module on PrimeXBT is the transparency the global leaderboards provide. Using fully transparent risk and success metrics, followers can sel ect safer strategies fr om the get-go, and ensure their capital is protected by those that properly know how.

It is still up to the follower, however, to watch stats within the leaderboards and not just total profits to understand the total performance of a strategy manager. One such way, has always been through the margin usage chart, which shows how much of a trader’s margin is being utilized in positions.

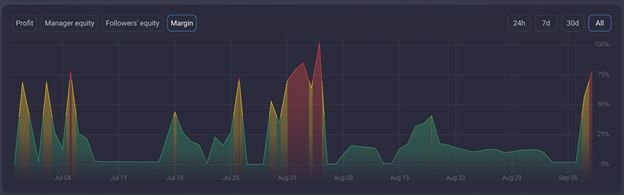

The higher the margin value, the more risk is involved, which is the way the tool has always worked. However, this latest update brings a color-coding system to the Covesting margin allocation chart, so followers can decipher what is what.

Before the update (above) versus the revised margin chart (below).

The safe zone of margin allocation and how it impacts risk

Green values in the chart indicate the margin allocation was less than 40% and in the safe zone. Yellow values show it might be time to take caution, as the strategy manager was demonstrating more aggressive usage patterns of between 40 to 70%. Finally, the chart turns red when risk is at the highest, with more than 70% margin used. Getting as close as 90% is seriously dangerous behavior and is a sign that the trader might have simply been lucky, isn’t as skilled as they think they are, and potentially in a panic.

To make things easier for followers to know which strategy managers are the safest out there,

one of the five stars in the Covesting rating system is dedicated solely to margin allocation. If a trader can stay in the green safe zone for 30 days and maintain that, they will be honored with one of the five available stars. All remaining stars are also geared toward putting a spotlight on strategies with careful risk management skills.

New margin chart update now live on Covesting, check it out

With this latest update now live within Covesting on PrimeXBT, followers should check out their followings and make sure the strategy they follow isn’t taking too bold of risks with their followers’ capital. Followers should also check back regularly on even the safest traders to make sure they stay on the straight and narrow.

While margin allocation was always a stat that Covesting provided as part of their success and risk metrics, this update makes it completely clear what is going on and what a follower needs to do should they see more red than green. If that is what they are noticing in the margin allocation chart, it won’t be long until the strategy’s bottom line turns red as well.

Stay smart, stay in profit, and check out the Covesting leaderboards regularly along with this new update on margin usage metrics.

Disclaimer. This article is paid and provided by a third-party source and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds in any company. CoinIdol shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any such content, goods or services mentioned in this article.

Price

Price

Price

News

(0 comments)