Coinidol.com: BNB Rises but Faces a $960 Barrier

Updated: Jan 16, 2026 at 22:23

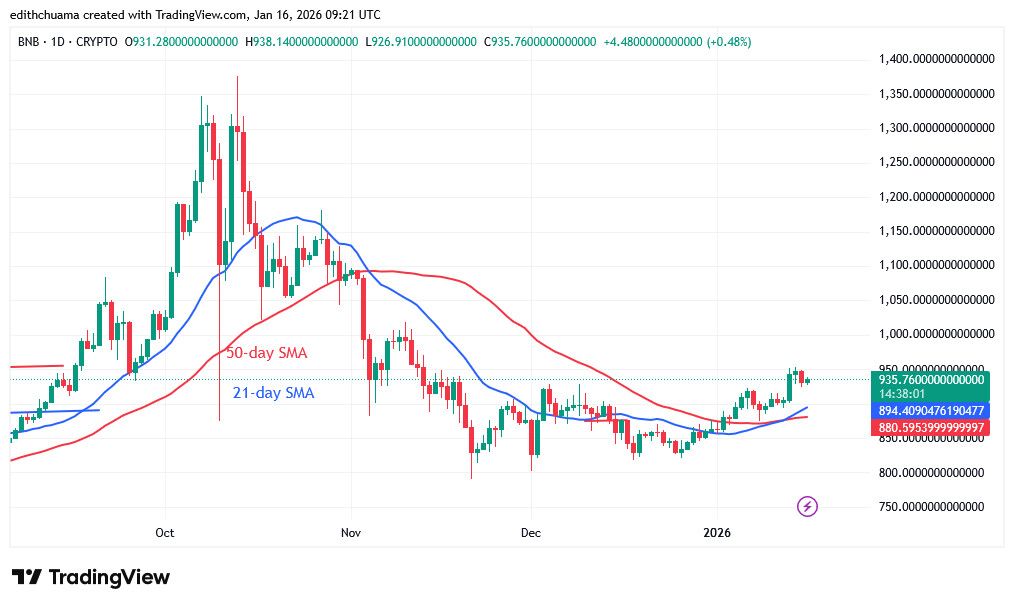

The price of BNB has maintained its upward trend despite a decline above the moving average lines.

BNB price long-term prediction: bullish

Since January 13, the uptrend has stalled below $960. The cryptocurrency is currently range-bound, trading above the moving average lines but below the $960 high.

On the upside, if buyers break above the $960 level, the rising trend could reach a high of $1,078. BNB will fall below the moving average lines if a bearish trend breaks through them, potentially tumbling to retest its critical support at $800. Meanwhile, BNB has retraced and remains above the $940 support.

Technical indicators:

-

Resistance Levels – $1,000, $1,050, $1,200

-

Support Levels – $900, $850, $800

BNB price indicators reading

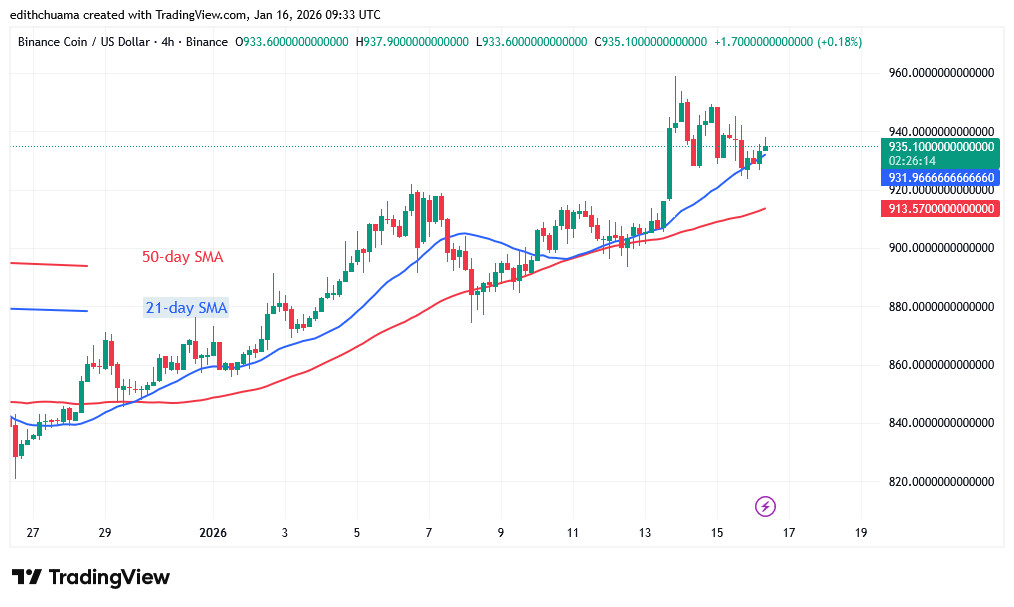

The price bars have been above the horizontal moving average lines since January 2. BNB will continue to rise as long as the price bars remain above the moving average lines. On the 4-hour chart, the price bars are above the upward-sloping moving average line. The uptrend will end if the price falls below the moving average lines.

What is the next direction for BNB/USD?

The BNB price is rising as the altcoin surpasses its $920 high. On the 4-hour chart, the uptrend has remained below the $950 level since January 14. BNB is currently trading in a narrow range above the moving average lines and below $950. The altcoin will trend once the current levels are breached. In the meantime, buyers are aiming to push the price past $950.

Disclaimer. This analysis and forecast are the personal opinions of the author. The data provided is collected by the author and is not sponsored by any company or token developer. This is not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by Coinidol.com. Readers should do their research before investing in funds.

Price

Price

Price

News

(0 comments)