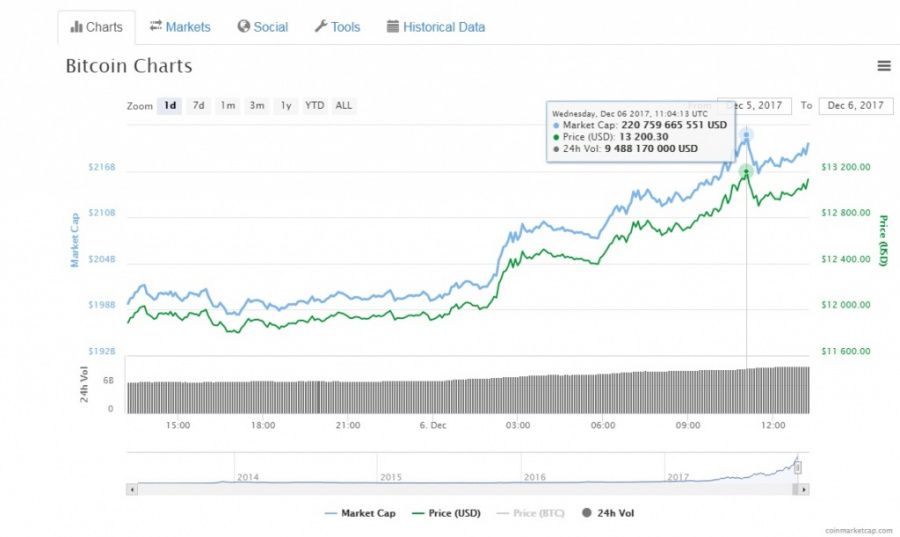

Bitcoin Price: BTC Breaks Through $13,000 Ahead of the CBOE’s Bitcoin Futures Launch

The upsurge of BTC price goes on. Bitcoin rated $13,200 on CoinMarketCap. This has probably become possible owing to CBOE’s and Gemini’s listing of bitcoin futures.

That announcement caused the market to turn optimistic enough for another all-time high, which is not surprising as CBOE is the largest options exchange in the world. The mere fact that such a giant turned to Bitcoin allows for improving its liquidity and, therefore, a price increase.

As of now, investors and hedge-funds have only three bitcoin investment options: Nordic Nasdaq-listed bitcoin exchange-traded fund (ETN) XBT Provider, Grayscale Investment’s Bitcoin Investment Fund (GBTC), and LedgerX’s US Commodities and Futures Trading Commission (CFTC). The launch of CBOE and CME bitcoin futures will provide investors with enough liquidity and tools for bitcoin investment.

According to Mark Dukas, Bitcoin and Blockchain Consultant, and cryptocurrency trader at BitcoinSmartMoney.com, “we are in a strong bull market and there is no reason to fight this trend until the price tells you.”

He stated to Coinidol:

“Bitcoin is traded at all-time highs what seems to be almost every day. There is an intense FOMO going on with new users and the spike in prices is very real. I have been charting Bitcoin using a proprietary algorithm for 3+ years. It went long on the daily chart October 17th 2015. This is the highest level the algo has ever reached and currently a 21.95 level. Volumes are real as the altcoin market continues to bleed, losses have transitioned into Bitcoins price gain.

New money continues to pour in coming in from US and International markets. The cryptocurrency market continues to grow at a staggering pace with Bitcoin now worth more than 483 of the S&P 500 companies as the market cap reaches $217 billion USD.

The technical charts tell us that mid-range support is at $7,713 resistance is at $12,947. The 50 & 200-day moving averages sloping upward and price trading above both levels by a considerable margin equates to a super strong bull. Whenever we see a dip, prices rebound very quickly as the buying is still outpacing sellers.”

Price

Price

Price

Price

News

(0 comments)