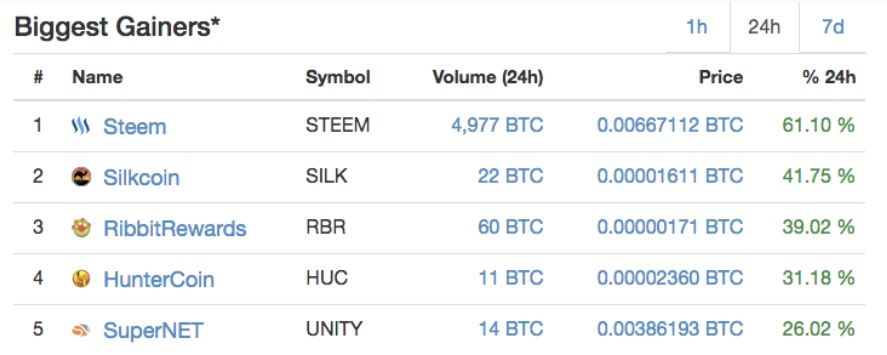

Top-5 Fast Moving Altcoins for Bulls and Bears

Low liquidity coins once again dominate the top 5 movers list as exit pumps and multi-month consolidation breakouts rule the day.

Analytics provided by BBA

Despite STEEM remaining in the top spot, a few of the other small cap coins might present better trading opportunities. Without further ado, let’s take a look at the technicals:

STEEM

We can see on the 12-hour chart below that price has done a full retrace of the initial list price and subsequent dump, but is now hitting very heavy resistance in the 0.007 area. If the bears put in a double top around that level, which is also near term OTE and supply resistance, then it could get ugly for the bulls. Downside into the OTE long zone shown in green would be the objective on a break of the trendline and MA’s. The technicals are signaling that caution is warranted despite the possibility of another test of the recent highs.

SILK

SilkCoin is a small cap coin with a fairly extensive price history that we were not previously aware of. The 3-day chart below is interesting from a technical perspective seeing as though price now seems to be sustainably above its ICO range. Heavy supply resistance will be tough to get through, however, especially considering RSI is already overbought and a shooting star candle is currently painting. Despite the longer term bullish market structure, it seems wise to wait for the market to come back down and consolidate given the A/D line is showing some distribution up here.

RBR

RibbitRewards is an appcoin that has been around for quite a while as well, although price action has never been all that interesting from a technical viewpoint. What was months of choppy consolidation broke to the upside recently, however the A/D line is indicating that this was simply an exit pump to get early adopters out at a profit. A flat out rejection at the 0.000006 level on sizeable volume is never a good sign, although a still oversold Willy and divergent RSI and MACD are telling us that perhaps we are in store for another multi-month range trade that frustrates both bulls and bears.

HUC

HunterCoin is another one we had never heard of, but that has some history behind it. We know nothing of the fundamentals, however the technicals do not look all that bad. Market structure has been bullish for quite some time and someone continues to accumulate in a longer term demand area. Temporary spikes also indicate buying action, although hitting a wall of resistance via the lower supply area and OTE short zone could prove too much for the bulls to break through for now. That said, if price can continue to hold the regional lows while the oscillators recharge then we could be looking at a decent opportunity on the long side at some point.

UNITY

SuperNet, yet another low liquidity coin that it not new to the scene, is catching a bid as well after a multi-year bear market and multi-month consolidation period. There is SMA resistance just overhead, but if the bulls can breakthrough that then there seems to be enough momentum via RSI and Willy to push up into the lower OTE short zone. Having said, that, the A/D line is indicating that there is not much action in this coin which makes it susceptible to liquidity spikes both to the upside and downside. Despite what could be a good opportunity, this one seems to be especially high risk, so proper risk management is absolutely necessary when playing in this sandbox.

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at the BullBear Analytics Disclaimers & Policies page.

BullBear Analytics

BullBear Analytics is the longest standing cryptocurrency forecasters in the market. They started in 2010, doing technical reports in bitcointalk.org, and have evolved into a buzzing community of traders. Adam is BBA’s chief analyst.

Price

News

Price

Price

News

(0 comments)