How the PRIVI Decentralized Credit System Works

Since the modern financial industry was created, banks have largely been the sole decision- maker of who gets access to credit. However, the credit approval system used by banks is incoherent and unfair.

For instance, the Economic Well-Being report released by the Federal Reserve in 2019 suggests that the criteria used by banks to approve access to credit are highly discriminatory.

The report found that non-white Americans were more likely to experience an adverse credit outcome compared to white Americans. One of the main goals of the PRIVI protocol is to reverse this trend, aiming to make credit more fair, and available to all. Something that current DeFi “lending,” has yet to achieve. Considering that most if not all DeFi “lending” protocols require users to lock assets in order to receive a loan.

How does that make sense? For all of the faults of centralized banking, at least they don’t say:

“OK, you want a $5,000 loan? Great, give us $10,000 then!”

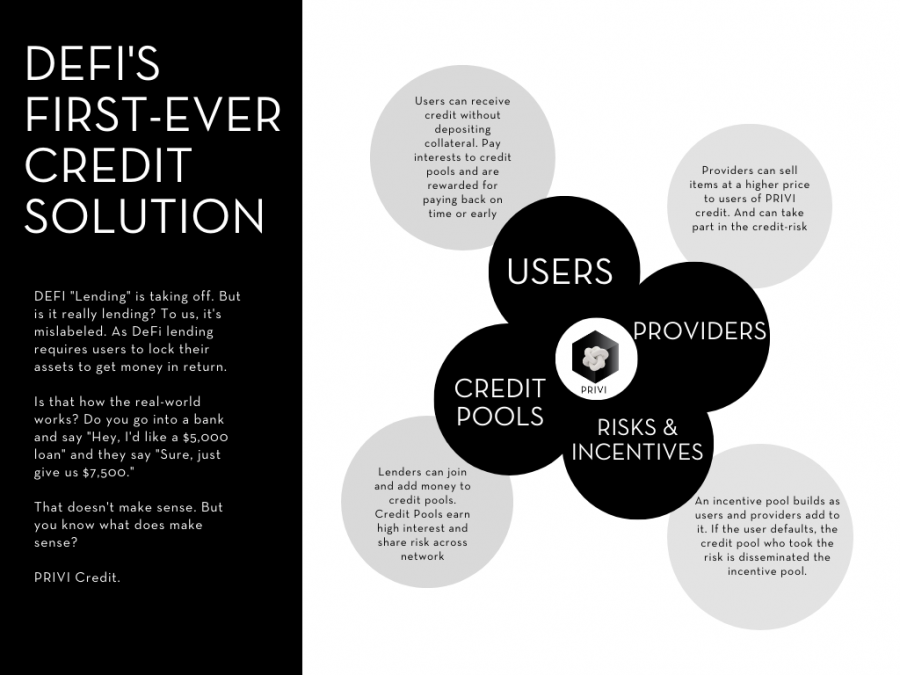

The first ever credit system for DeFi

As of September 2020, nearly $4bn in locked assets exist in DeFi lending protocols. PRIVI aims to change this, and help give users access to a credit system that does not require them to lock funds, in order to get funds.

To help achieve this goal, the PRIVI Protocol has created two technologies: the PRIVI Digital ID and PRIVI Credit.

The PRIVI Digital ID compiles the user’s shared data which quantifies a users financial trustworthiness, and combines it with network endorsements. These indexes are supported by AI techniques that aim to help create a more fair Digital ID so users can participate in potentially receiving credit, and for credit pools, to transparently assess risk.

PRIVI Credit is an innovative system that connects users looking to receive credit, with decentralized credit pools. Credit pools being a group of lenders who customize which kind of Digital ID’s they want to lend too, how long they wish to lock funds and what interest they aim to accumulate. This decentralized credit system works on a novel risk and incentive distribution model, rewarding good behavior, helping merchants sell items for higher prices and minimizing risk for credit pools. To learn more see the PRIVI light paper.

Disclaimer. This press release is provided by a third-party source. This press release is for informational purposes only and should not be viewed as an endorsement by CoinIdol. We take no responsibility and give no guarantees, warranties or representations, implied or otherwise, for the content or accuracy. Readers should do their own research before investing funds in any company.

Price

Price

Price

Price

Price

(0 comments)