Cryptocurrencies Bounce as the Bear Markets Gradually Relinquish Hold

The following coins namely: Bitcoin SV (BSV), Litecoin (LTC), EOS, Binance Coin (BNB), and Tezos (XTZ) are back in a bull market. The coins are making frantic effort to break the current resistance to be out of the downtrend zone. One common feature among the coins is that the coins are in strong bullish momentum.

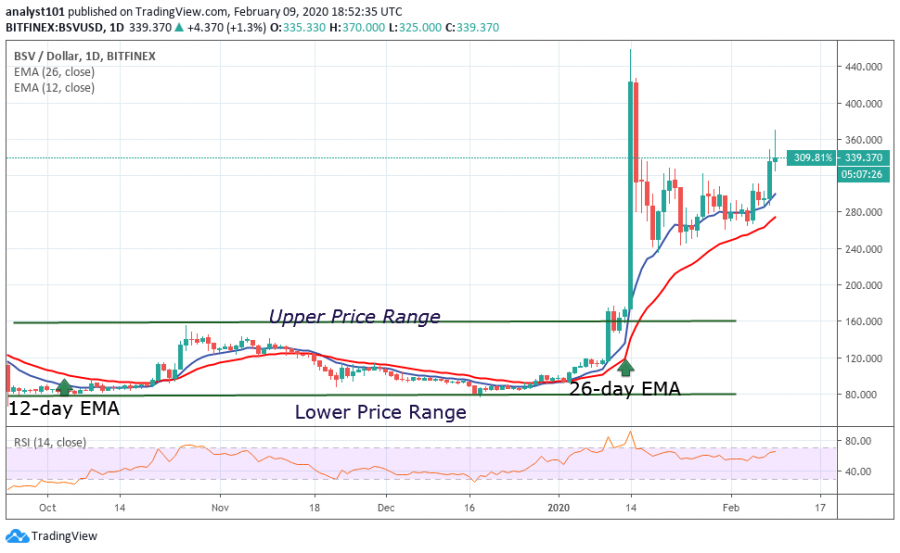

BSV/USD Major Trend: Bullish

Bitcoin SV settled to a sideways move after a price rally. On January 14, BSV had a price rally and price reached a high of $440. Unfortunately, the bulls could not sustain the uptrend as the coin fell. The coin nosedived to the low of $240 and continued fluctuation between the $240 and $360. BSV has been trading in a sideways trend for the past one month.

The coin will have an opportunity of an uptrend if price breaks above $360 resistance. Then the bulls will have the chance to break or retest the $440 resistance. A successful break will see BSV reach a high of $520. Any unsuccessful attempt will push the coin to a sideways trend. Surprisingly, BSV is above level 64 of the RSI period 14. It indicates that the pair is in an uptrend zone.

LTC/USD Major Trend: Bullish

Today, February 9, LTC is retracing after reaching a high of $77.50. In January, the bulls successfully broke the resistance levels of $50 and $62. In February, the bulls overcame the resistance at $72 after a week of battle. The bulls broke the resistance at $72 but failed to rally above $80. The coin reached a high of $77.50 and was resisted.

The pair is currently on a downward move. Litecoin is currently trading above 80% of the daily stochastic. This implies that the coin is in the overbought region of the market. The implication is that buying has been overdone. Buyers will not be available to push the coin upward in the region. Rather, the presence of sellers cannot be ruled out. The downtrend was as a result of the presence of sellers.

EOS/USD Major Trend: Bullish

Recently, EOS was in a bullish run as the bulls broke the resistance at $4. The resistance at $4.0 has been a knotty price level. EOS traded below the resistance for two weeks before it was eventually broken. Today, the pair has reached a high of $5.0 but the uptrend is temporarily on hold. In my bullish view, if the bulls break the resistance at $5, the pair will rally above $6.

EOS is likely to be out of the bear market. Meanwhile, as the coin went to a high of $5.0, the RSI also rose to level 80. This indicates that the market is in the overbought region. The EOS upward move is doubtful as the coin is likely to fall. Sellers are likely to take control of prices.

BNB/USD Major Trend: Bullish

Binance Coin is in a bull market as the price breaks the downtrend line on January 10. BNB has risen to $23 after the breakout. The uptrend is possible, if the bulls overcome the resistance at $24 and $25. Binance Coin will rally above $30 if the bulls break the resistance levels.

The coin is currently trading at $23.83, approaching the resistance at $24. BNB is also above 80% of the daily stochastic. Even though the coin is in a strong bullish momentum, it is also in the overbought region. BNB is expected to be on the downward move as sellers push price downward. The uptrend will resume as soon as the price finds support.

XTZ/USD Major Trend: Bullish

Tezos is making impressive moves after breaking the overhead resistance at $1.80. The upward move is likely as the bulls reach a high of $62. Tezos is trading at level 80 of the RSI period 14. This indicates that the coin is in strong bullish momentum and it is overbought. There is a possibility that the price of the coin will rise. The coin is also likely to face selling pressure as it is in the overbought region.

Disclaimer. This analysis and forecast are the personal opinions of the author are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds.

Price

Price

Price

Price

Price

(0 comments)